Your Income tax book 2020 pdf images are ready. Income tax book 2020 pdf are a topic that is being searched for and liked by netizens now. You can Download the Income tax book 2020 pdf files here. Get all royalty-free photos.

If you’re searching for income tax book 2020 pdf pictures information connected with to the income tax book 2020 pdf topic, you have come to the ideal site. Our website always gives you suggestions for seeking the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

Income Tax Book 2020 Pdf. Public companies that satisfy a minimum listing requirement of 40% and other conditions are entitled to a tax cut of 5% off the standard rate, giving them an effective tax rate of 20% (refer to page 68). For each child under age 19 or student under age 24 who received more than $2,200 of investment income in 2020, complete form 540 and form ftb 3800, tax computation for certain children with unearned income, to figure the tax on a separate form 540 for your child. The tds rate of 2% chargeable for cash withdrawals above rs.1 crore in a year. The estimates presented in this book represent what the revenue impact would be if the proposed tax law changes were in effect for the entire year.

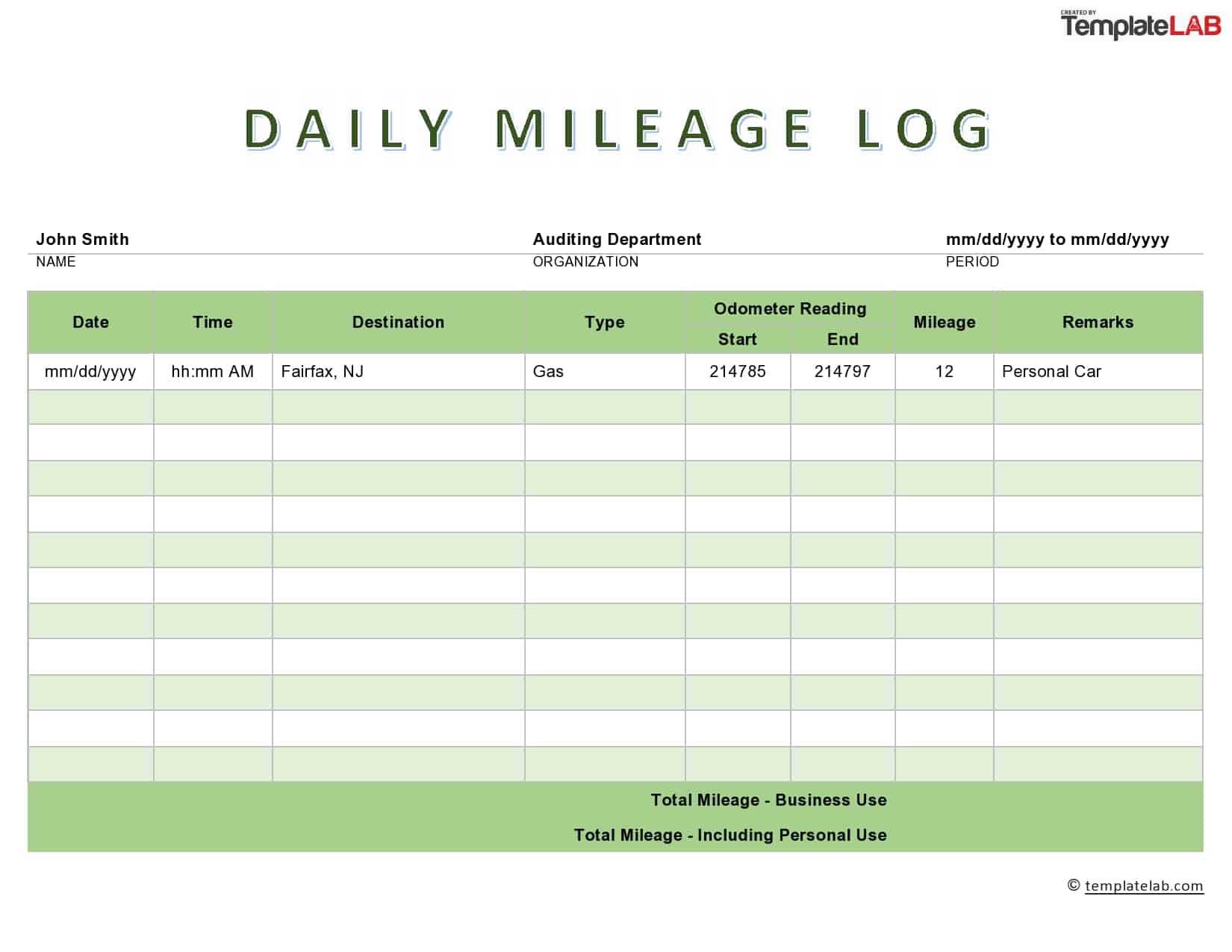

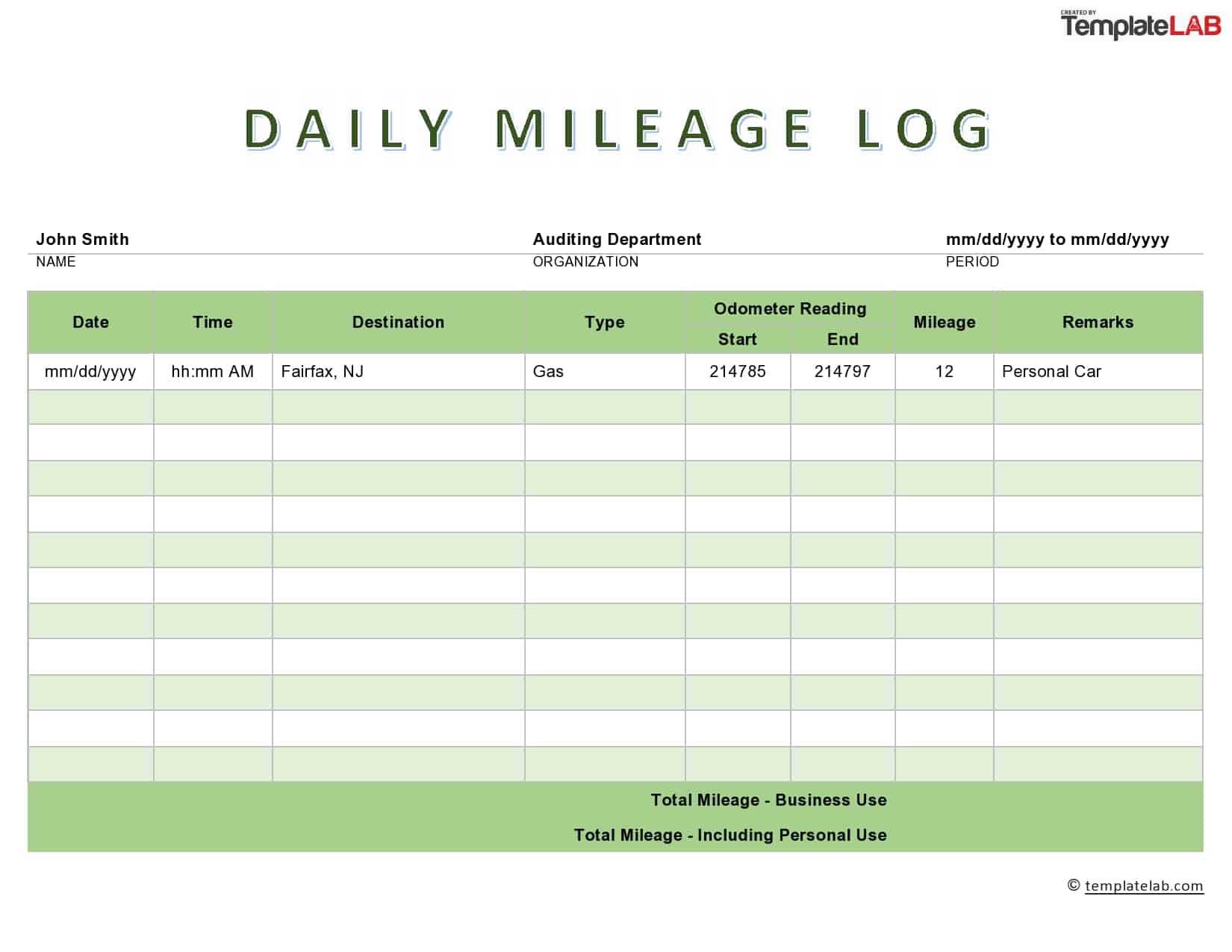

31 Printable Mileage Log Templates (Free) ᐅ Templatelab From pinterest.com

31 Printable Mileage Log Templates (Free) ᐅ Templatelab From pinterest.com

Download or read online canadian income tax act with regulations annotated fall 2020 full in pdf, epub and kindle. Submit tax returns for normal tax purposes. Normal delays caused by collection and implementation lags, will reduce the actual revenue impact in the first year. Sales tax, individual income tax, corporate income tax, and insurance premium tax. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. The estimates presented in this book represent what the revenue impact would be if the proposed tax law changes were in effect for the entire year.

Page 2 in this booklet.

Download income tax law notes, pdf, books, syllabus for b com, bba 2021.we provide complete income tax law pdf. Public companies that satisfy a minimum listing requirement of 40% and other conditions are entitled to a tax cut of 3% off the standard rate, Download income tax law notes, pdf, books, syllabus for b com, bba 2021.we provide complete income tax law pdf. Surcharge had been increased to 25% for income between 2 crore to 5 crore and to 37% for income above 5 crore annually. Canadian income tax act with regulations annotated fall 2020. There is open book examination for this elective subject of professional programme.

Source: pinterest.com

Source: pinterest.com

The estimates presented in this book represent what the revenue impact would be if the proposed tax law changes were in effect for the entire year. Changes in budget 2020 of income tax slabs. Canadian income tax act with regulations annotated fall 2020. Download or read online canadian income tax act with regulations annotated fall 2020 full in pdf, epub and kindle. Each package includes the guide, the return, and related schedules, and the provincial information and forms.

Source: pinterest.com

Source: pinterest.com

Other files by the user. Submit tax returns for normal tax purposes. Surcharge had been increased to 25% for income between 2 crore to 5 crore and to 37% for income above 5 crore annually. Changes in budget 2020 of income tax slabs. Download or read online canadian income tax act with regulations annotated fall 2020 full in pdf, epub and kindle.

Source: pinterest.com

Source: pinterest.com

Other files by the user. A kpmg tax alert describing the persons who must submit an income tax return for the 2020/2021 tax year of assessment will be issued once the relevant government gazette has been published (expected in june 2020). Other files by the user. Sales tax, individual income tax, corporate income tax, and insurance premium tax. Each package includes the guide, the return, and related schedules, and the provincial information and forms.

Source: pinterest.com

Source: pinterest.com

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. In fy 2020, these 4 taxes represented 94.6% of ongoing general fund revenue. • election to use your 2019 earned income to figure your 2020 additional child tax credit. Changes in budget 2020 of income tax slabs. The tds rate of 2% chargeable for cash withdrawals above rs.1 crore in a year.

Source: pinterest.com

Source: pinterest.com

• election to use your 2019 earned income to figure your 2020 additional child tax credit. Sales tax, individual income tax, corporate income tax, and insurance premium tax. Income tax law study material includes income tax law notes, income tax law book, courses, case study, syllabus, question paper, mcq, questions and answers and available in income tax law pdf form. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Earned income to figure your 2020 earned income credit.

Source: pinterest.com

Source: pinterest.com

Each package includes the guide, the return, and related schedules, and the provincial information and forms. Revenue code for tax year 2020 including the cares act and caa. Other files by the user. Public companies that satisfy a minimum listing requirement of 40% and other conditions are entitled to a tax cut of 3% off the standard rate, Sales tax, individual income tax, corporate income tax, and insurance premium tax.

Source: in.pinterest.com

Source: in.pinterest.com

Revenue code for tax year 2020 including the cares act and caa. Normal delays caused by collection and implementation lags, will reduce the actual revenue impact in the first year. A kansas corporate income tax return must be filed by all corporations doing business in or deriving income from sources within kansas who are required to file a federal income tax return, whether or not a tax is due. This is the main menu page for the t1 general income tax and benefit package for 2020. Income tax law study material includes income tax law notes, income tax law book, courses, case study, syllabus, question paper, mcq, questions and answers and available in income tax law pdf form.

Source: pinterest.com

Source: pinterest.com

Other files by the user. This book written by anonim and published by unknown which was released on 16 september 2021 with total pages null. As noted in the chart below, the largest category is the state sales tax, which represented 46.5% of general fund revenue collections in 20fy 20. Other files by the user. Page 2 in this booklet.

Source: pinterest.com

Source: pinterest.com

As noted in the chart below, the largest category is the state sales tax, which represented 46.5% of general fund revenue collections in 20fy 20. Individuals can select the link for their place of residence as of december 31, 2020, to get the forms and information needed to file a general income tax and benefit return for 2020. There is open book examination for this elective subject of professional programme. Public companies that satisfy a minimum listing requirement of 40% and other conditions are entitled to a tax cut of 5% off the standard rate, giving them an effective tax rate of 20% (refer to page 68). Normal delays caused by collection and implementation lags, will reduce the actual revenue impact in the first year.

Source: in.pinterest.com

Source: in.pinterest.com

Canadian income tax act with regulations annotated fall 2020. Public companies that satisfy a minimum listing requirement of 40% and other conditions are entitled to a tax cut of 5% off the standard rate, giving them an effective tax rate of 20% (refer to page 68). Pwc indonesia indonesian pocket tax book 2021 1 corporate income tax corporate income tax tax rates generally a flat rate of 22% applies for fiscal year 2021 and reduced to 20% starting fiscal year 2022. Earned income to figure your 2020 earned income credit. This is the main menu page for the t1 general income tax and benefit package for 2020.

Source: pinterest.com

Source: pinterest.com

Public companies that satisfy a minimum listing requirement of 40% and other conditions are entitled to a tax cut of 5% off the standard rate, giving them an effective tax rate of 20% (refer to page 68). Surcharge had been increased to 25% for income between 2 crore to 5 crore and to 37% for income above 5 crore annually. For each child under age 19 or student under age 24 who received more than $2,200 of investment income in 2020, complete form 540 and form ftb 3800, tax computation for certain children with unearned income, to figure the tax on a separate form 540 for your child. The estimates presented in this book represent what the revenue impact would be if the proposed tax law changes were in effect for the entire year. This book written by anonim and published by unknown which was released on 16 september 2021 with total pages null.

Source: pinterest.com

Source: pinterest.com

In fy 2020, these 4 taxes represented 94.6% of ongoing general fund revenue. Download or read online canadian income tax act with regulations annotated fall 2020 full in pdf, epub and kindle. A kansas corporate income tax return must be filed by all corporations doing business in or deriving income from sources within kansas who are required to file a federal income tax return, whether or not a tax is due. The estimates presented in this book represent what the revenue impact would be if the proposed tax law changes were in effect for the entire year. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

Source: pinterest.com

Source: pinterest.com

Earned income to figure your 2020 earned income credit. Dependents, qualifying child for child tax credit, and credit for other dependents. This is the main menu page for the t1 general income tax and benefit package for 2020. Page 2 in this booklet. Download or read online canadian income tax act with regulations annotated fall 2020 full in pdf, epub and kindle.

Source: pinterest.com

Source: pinterest.com

An income tax is a tax that governments impose on income generated by businesses and individuals within. Total income and adjusted gross income. Canadian income tax act with regulations annotated fall 2020. Normal delays caused by collection and implementation lags, will reduce the actual revenue impact in the first year. Public companies that satisfy a minimum listing requirement of 40% and other conditions are entitled to a tax cut of 3% off the standard rate,

Source: pinterest.com

Source: pinterest.com

Canadian income tax act with regulations annotated fall 2020. This is the main menu page for the t1 general income tax and benefit package for 2020. Each package includes the guide, the return, and related schedules, and the provincial information and forms. Submit tax returns for normal tax purposes. Individuals can select the link for their place of residence as of december 31, 2020, to get the forms and information needed to file a general income tax and benefit return for 2020.

Source: pinterest.com

Source: pinterest.com

Public companies that satisfy a minimum listing requirement of 40% and other conditions are entitled to a tax cut of 5% off the standard rate, giving them an effective tax rate of 20% (refer to page 68). Total income and adjusted gross income. Earned income to figure your 2020 earned income credit. In fy 2020, these 4 taxes represented 94.6% of ongoing general fund revenue. Income tax law study material includes income tax law notes, income tax law book, courses, case study, syllabus, question paper, mcq, questions and answers and available in income tax law pdf form.

Source: pinterest.com

Source: pinterest.com

Each package includes the guide, the return, and related schedules, and the provincial information and forms. Sales tax, individual income tax, corporate income tax, and insurance premium tax. Download income tax law notes, pdf, books, syllabus for b com, bba 2021.we provide complete income tax law pdf. Submit tax returns for normal tax purposes. There is open book examination for this elective subject of professional programme.

Source: pinterest.com

Source: pinterest.com

In fy 2020, these 4 taxes represented 94.6% of ongoing general fund revenue. A kpmg tax alert describing the persons who must submit an income tax return for the 2020/2021 tax year of assessment will be issued once the relevant government gazette has been published (expected in june 2020). Page 2 in this booklet. Dependents, qualifying child for child tax credit, and credit for other dependents. Revenue code for tax year 2020 including the cares act and caa.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title income tax book 2020 pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.